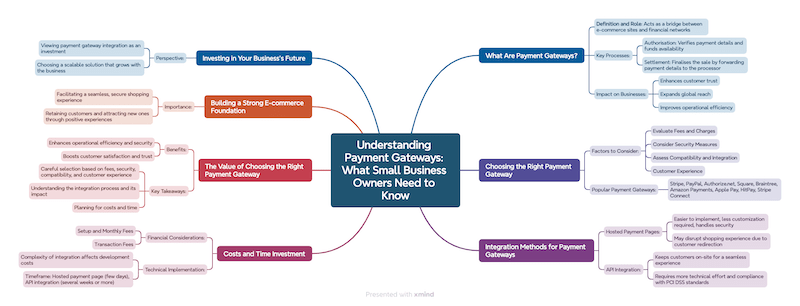

As a web developer who has navigated the complexities of e-commerce for various clients, I’ve witnessed firsthand the transformative power of online sales for small businesses. However, integrating e-commerce into your operations isn’t just about setting up a website; it’s crucial to select the right payment gateway. This choice can significantly affect your customer’s experience, security, and even your business’s credibility. Through this article, I aim to share my insights into payment gateways, helping you understand their importance and how to choose and integrate the best option for your business.

What Are Payment Gateways?

A payment gateway is much more than a mere tool for processing payments. It acts as a bridge between your e-commerce website and the financial network that processes the payment. Here’s the basic workflow:

- Authorisation: When your customer completes a purchase, the gateway verifies their payment details and checks if the funds are available.

- Settlement: If the transaction is authorised, the gateway forwards the payment details to the processor to finalise the sale.

This process is essential for facilitating secure online transactions. As a developer, I’ve seen how a robust payment gateway can significantly impact:

- Customer Trust: A secure and efficient gateway reassures customers, enhancing their willingness to buy from your site.

- Global Reach: A versatile gateway that allows you to accept payments from customers around the world, expanding your market.

- Operational Efficiency: Automating payment processing can save you time and reduce manual errors.

Choosing and integrating the right payment gateway requires careful consideration, which we will explore in the following sections. From my journey in e-commerce development, I’ll share practical tips on making the best choice for your business.

Choosing the Right Payment Gateway

Deciding on the right payment gateway for your e-commerce site is a pivotal decision in my experience as a web developer. It’s not just about fees or compatibility; it’s about aligning with your business goals, ensuring security, and providing the best possible customer experience. Here’s what I’ve learned about selecting a payment gateway:

- Evaluate Fees and Charges: Every payment gateway has its structure of fees, including transaction fees, monthly fees, or setup fees. It’s essential to understand these costs upfront and consider how they align with your sales volume and pricing strategy.

- Consider Security Measures: The gateway must comply with the Payment Card Industry Data Security Standard (PCI DSS). I always recommend choosing a gateway that offers additional security features, such as fraud detection and encryption, to protect your customers’ data.

- Assess Compatibility and Integration: The gateway should integrate seamlessly with your website’s platform and shopping cart. From my projects, I’ve found that some gateways offer plugins or APIs that make integration smoother, which can save you a lot of time and hassle.

- Customer Experience: The checkout process should be straightforward and quick. A payment gateway that offers a good user experience, such as minimal redirects and the ability to store payment information securely for future transactions, can significantly reduce cart abandonment rates.

Some of the popular payment gateways I’ve worked with include PayPal, Stripe, and WorldPay. Each has its pros and cons, so I always suggest conducting thorough research and considering your specific business needs before making a decision.

Top Payment Gateways

Stripe: Stripe stands out for its developer-friendly API, allowing for customisable payment solutions, and its robust support for international payments, making it ideal for global e-commerce.

PayPal: Renowned for its wide acceptance and user trust, PayPal offers seamless integration for e-commerce sites and provides buyers with flexible payment options, enhancing customer convenience.

Authorize.net: A veteran in the payment gateway space, Authorize.net is celebrated for its reliability, extensive security features, and support for a wide range of currencies and payment types.

Square: Known for its ease of use and seamless integration with physical POS systems, Square is perfect for businesses that operate both online and offline, offering a unified payment solution.

Braintree: Owned by PayPal, Braintree offers advanced payment features like PayPal integration, Venmo (in the US), and support for cryptocurrency, making it a versatile choice for tech-savvy businesses.

Amazon Payments: Leveraging Amazon’s massive user base, Amazon Payments enables businesses to offer a familiar checkout experience, increasing trust and potentially boosting conversion rates.

Apple Pay: With its focus on user experience, Apple Pay provides a fast and secure checkout process for customers using Apple devices, enhancing the mobile shopping experience significantly.

HitPay: HitPay is appreciated for its no-code payment solutions, making it exceptionally accessible for small businesses without technical expertise, and its support for a wide array of payment methods.

Stripe Connect: Specifically designed for platforms and marketplaces, Stripe Connect offers comprehensive payment functionality with the ability to route payments, manage accounts, and automate payouts, making it perfect for business models that involve third-party sellers or service providers.

Integration Methods for Payment Gateways

Integrating a payment gateway into your e-commerce site can seem daunting, but with the right approach, it’s quite manageable. Based on my experience, there are mainly two methods to consider:

- Hosted Payment Pages: This method redirects your customers to the payment gateway’s platform to complete the transaction. It’s easier to implement since it requires less customisation and handles security for you. However, it can disrupt the shopping experience by taking customers away from your site.

- API Integration: Directly integrating the payment gateway via its API keeps customers on your site during checkout, offering a seamless experience. This method requires more technical effort and must ensure your site complies with PCI DSS standards, but it gives you greater control over the checkout process.

The choice between these methods depends on your technical resources, security considerations, and the importance of customer experience in your business strategy. In my projects, I’ve found API integration to offer the best customer experience but recommend hosted payment pages for businesses with limited technical support.

Costs and Time Investment

Investing in a payment gateway involves both time and money. The costs can vary widely depending on the gateway’s fee structure and the integration method you choose. Here are some considerations:

- Setup and Monthly Fees: Some gateways charge an initial setup fee and monthly fees regardless of transaction volume.

- Transaction Fees: Typically, gateways charge a percentage of the transaction amount plus a fixed fee.

- Technical Implementation: The complexity of the integration can affect development costs. API integration usually requires more resources than setting up a hosted payment page.

From my experience, integrating a simple hosted payment page can take a few days, while a full API integration might take several weeks or more, depending on the complexity of your site and the level of customisation you desire.

In summary, the key to successful payment gateway integration is careful planning and consideration of your business needs, security, customer experience, and budget. With the right approach, you can enhance your e-commerce operation’s efficiency and reliability, ultimately boosting sales and customer satisfaction.

The Value of Choosing the Right Payment Gateway

Embarking on the journey of integrating a payment gateway into your e-commerce platform might seem like a daunting task at first, especially when considering the technical aspects and financial commitments involved. However, based on my years of experience as a web developer, I can assure you that the effort is well worth it. The right payment gateway can significantly enhance your business’s operational efficiency, security, and, most importantly, customer satisfaction and trust.

Here are some key takeaways I’d like to share:

- Careful Selection Is Crucial: Take the time to research and compare different payment gateways. Consider fees, security features, compatibility with your e-commerce platform, and the overall customer experience.

- Understand the Integration Process: Whether you opt for a hosted payment page or API integration, make sure you understand the level of technical effort required and the impact on your website’s user experience.

- Plan for Costs and Time: Be prepared for the initial and ongoing costs associated with your chosen payment gateway. Budget for both monetary expenses and the time investment needed for integration and ongoing maintenance.

Building a Strong E-commerce Foundation

From my personal experience, integrating a payment gateway is not just about facilitating transactions; it’s about building a robust foundation for your e-commerce business. It’s about ensuring that your customers have a seamless, secure, and enjoyable shopping experience on your site. This not only helps in retaining customers but also attracts new ones through positive word-of-mouth.

Investing in Your Business’s Future

To my fellow small business owners, I encourage you to view the selection and integration of a payment gateway as an investment in your business’s future. With the right approach and careful consideration, you can choose a payment gateway that not only meets your current needs but also scales with your business as it grows.

Remember, in the digital age, the ease and security of online transactions are paramount. By prioritising the integration of a high-quality payment gateway, you’re not just optimising your e-commerce operations; you’re also enhancing your brand’s reputation and paving the way for long-term success.